Work Trip + #NoSpendWeek - November Expenses

In May 2017 it hit me that I had spent the last year and a half in a full-time salaried position, plus 9 years before that working for money. Yet, I had no idea what my income had brought me. I wasn't saving for retirement, I didn't have a freedom fund, and I still had student loans! Where was all the money I had ever made? Was I spending based on my values?

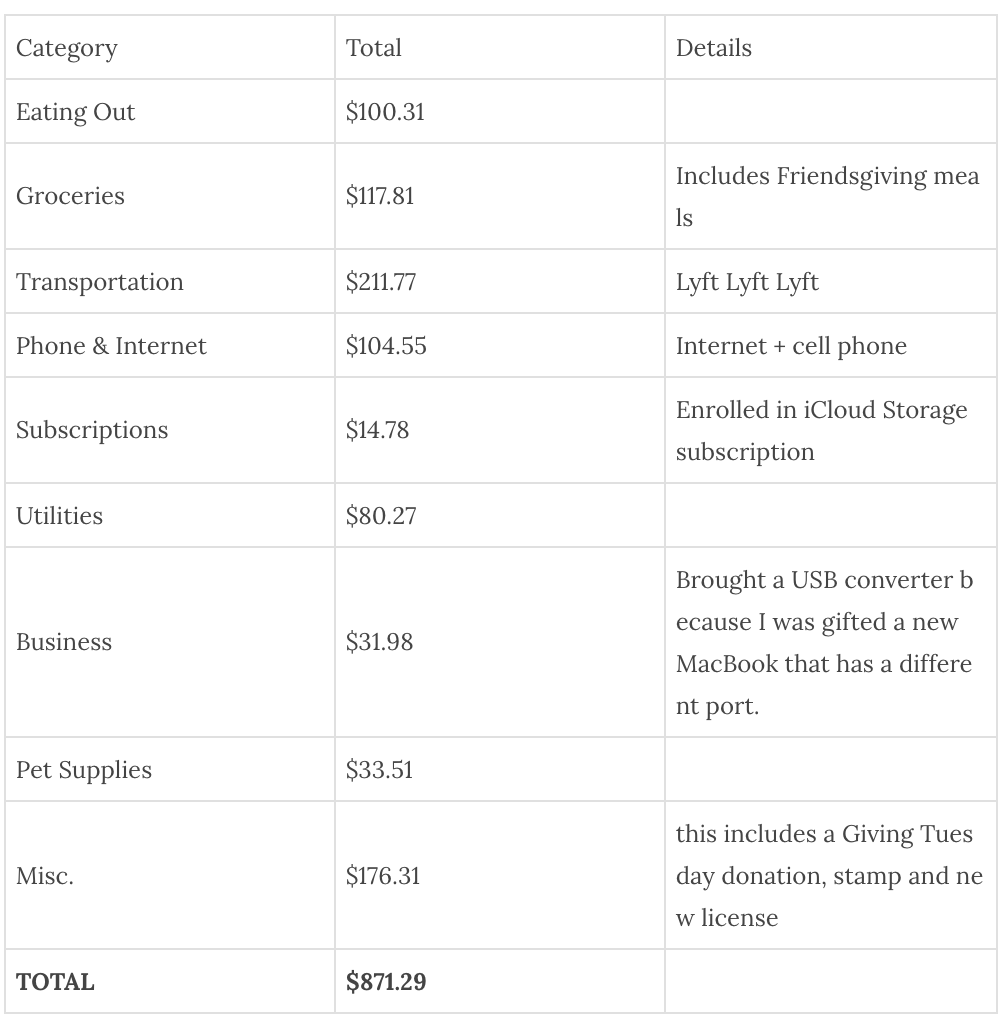

This prompted me to start tracking every single purchase. I wanted to know exactly where my money was going. I wanted to start building wealth, but in order to start, I needed to understand my spending trends.

The #MonthlyExpenses segment is an effort to keep myself accountable for my purchases and on track for my savings and debt payoff goals.

**

November is my favorite month of year - I mean Scorpio season and fall weather before snow storms, who can complain?

I started off the month with a no-spending week to help me feel better for our Iceland trip expenses. The first week went so well, I didn't spend anything until the 15th. What really helped though was having a work trip the second weekend of the month and falling sick at the same time.

Work covered my travel and meals, and since I stayed in my hotel room the whole time there was no temptation to spend. I forgot to mention this work trip was in Las Vegas, now, if you know me, you know I'm not a fan.

Yet, I had ever intention to at least leave my hotel room. But when you almost faint on your flight over and have a high fever, you bet I'll be hibernating when I'm not working.

I flew back from Vegas on a red-eye so I decided to work from home that Monday, this gave me the time I needed to prepare guava and cheese empanadas for our Thanksgiving office potluck. Potlucks alone are a big part of why I love this time of year, so Ari and I decide to host a Friendsgiving one. I made a total of 50 empanadas for the holiday celebrations and that was still not enough. Ari and I also prepared this Blue Apron orzo salad, of course, sans chicken. Ari doesn't have a Blue Apron subscription anymore, but he kept his recipes and this one is by far our favorite.

We opted for a Green Friday, where we enjoy the outdoors instead of shopping. There's nothing I need or want and I don't really go to the mall anymore so not shopping on Black Friday wasn't hard.

Transportation expenses are high this month mainly due to the $127 Lyft ride I took the night of my birthday party - Ari paid for half, but still the highest ride I've taken. Still, I don't regret it. Birthday splurges are okay sometimes.

In November I reached my emergency savings goal of 10k! At-fucking-last! It seems like forever ago that I shifted my goal to funding this ER, but we're here and now I can shift it back to paying off my student loans. This month I thought about taking on a side-job like working part-time at Target during the holidays, but I didn't follow through. It's still a thought on my mind because I really want to get rid of this debt. I'll revisit this in December.